Medicare, a vital health insurance program in the United States, serves as a lifeline for millions of Americans, offering coverage to 65 million individuals. Within this vast landscape, a variety of coverage options exist, each catering to different demographic segments and ensuring beneficiaries can access necessary healthcare services without incurring insurmountable expenses. In this blog post, we delve into the intricate web of Medicare coverage types, drawing insights from the 2020 Medicare Current Beneficiary Survey.

Understanding the Core Coverage Spectrum

Two primary avenues define the coverage spectrum for Medicare beneficiaries: traditional Medicare and Medicare Advantage private plans. While traditional Medicare offers a tried-and-true approach, Medicare Advantage plans, provided by private companies, infuse innovation into the equation. The latter come with an out-of-pocket spending cap and often encompass supplementary benefits. Notably, these supplementary benefits hold immense value, shielding beneficiaries from unlimited out-of-pocket costs and potentially bridging gaps in coverage that traditional Medicare might leave exposed.

The Coverage Mosaic: Who’s Covered and How

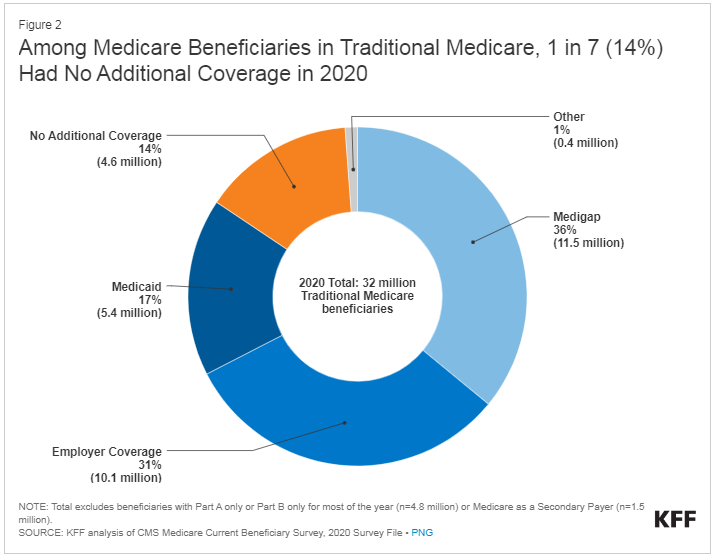

A glance at the 2020 data reveals that the majority of Medicare beneficiaries enjoy a comprehensive safety net. More than 90% fall into two categories: those combining traditional Medicare with supplementary coverage like Medigap, employer-sponsored plans, or Medicaid (48%), or those opting for Medicare Advantage plans (44%). However, a concerning number—close to five million individuals—are left without additional coverage, primarily comprising low-income beneficiaries who could be at risk of high medical expenses.

Diving Deeper into Coverage Sources

Traditional Medicare: Among beneficiaries enrolled in traditional Medicare, 86% hold supplementary coverage. This encompasses Medigap (36%), employer coverage (31%), Medicaid (17%), or other sources (1%). Notably, 14% lack supplementary coverage.

-

- Medigap: Approximately 20% of Medicare beneficiaries are covered by Medigap, private insurance policies that fill coverage gaps in Medicare Parts A and B. While these policies offer protection against excessive medical expenses, their premiums can escalate with age and location.

-

- Employer Coverage: About 27% of beneficiaries benefit from employer-sponsored health insurance, either alongside traditional Medicare (31%) or through Medicare Advantage employer group plans (Appendix Table 1). This mix caters to both retirees and active workers.

-

- Medicaid: Serving low-income individuals, Medicaid extends its umbrella to nearly 10.7 million beneficiaries with modest assets. Dual-eligible individuals enjoy a mix of Medicare and Medicaid benefits, ensuring access to necessary medical services and support.

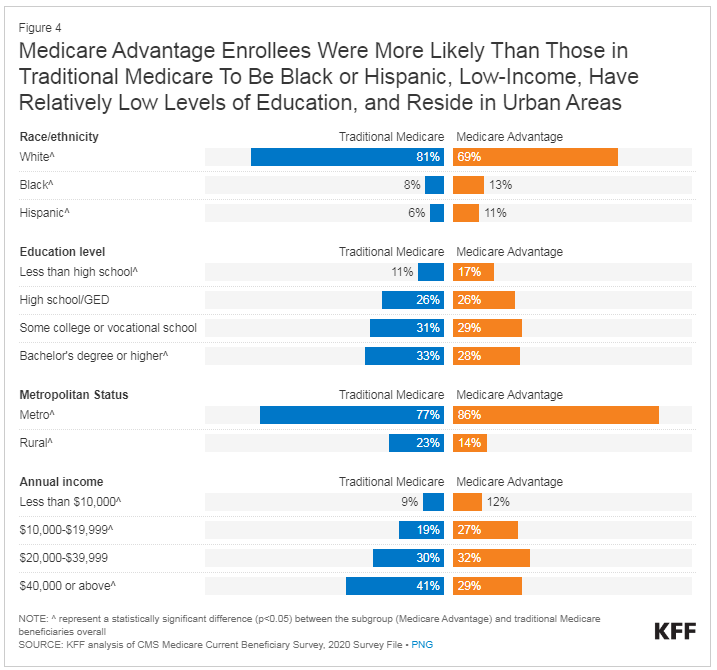

Unveiling Demographic Patterns

A closer examination of each coverage type exposes interesting demographic trends. Beneficiaries with Medigap coverage tend to be White, with higher incomes and education levels. Those with employer coverage exhibit similar attributes, showcasing relatively higher incomes, better health, and educational attainment. In contrast, dual-eligible individuals, enrolled in both Medicare and Medicaid, often belong to minority groups with lower income and education levels.

Facing the Gaps: No Additional Coverage

The unfortunate reality is that nearly 1 in 10 Medicare beneficiaries (8%) navigate the healthcare landscape with only traditional Medicare coverage. Without supplementary protection, these individuals face the full brunt of cost-sharing requirements, leading to potential financial strain. This group is more likely to have moderate incomes, be under 65 years of age, and be predominantly male.

This study draws insights from the 2020 Medicare Current Beneficiary Survey (MCBS), examining supplementary coverage sources. Encompassing 57.7 million beneficiaries, the analysis excludes specific segments while focusing on Part A and Part B benefits. Statistical significance is upheld (p<0.05). The count of dual-eligible individuals differs from a separate KFF analysis due to data source variations. The robust methodology considers MCBS’s complex sampling design. While rounding discrepancies may occur, the study provides a comprehensive understanding of Medicare coverage dynamics and their impact.

The Rise of Medicare Advantage

Medicare Advantage, the progressive face of Medicare, covers over 40% of beneficiaries in 2020. These plans, increasingly popular, offer diversity through various branches, including employer- or union-sponsored plans and Special Needs Plans (SNPs) tailored to specific care needs. Medicare Advantage enrollees often represent minority groups and urban dwellers with lower incomes and education levels.

The world of Medicare coverage is nuanced, catering to diverse needs and demographics. While the majority enjoy the protective cocoon of supplementary coverage, there remains a significant population grappling with limited protection. As Medicare continues to evolve, bridging these gaps and ensuring equitable access to healthcare will be paramount. Understanding the intricate tapestry of coverage types and their impact on beneficiaries is essential as we strive for a more inclusive healthcare system.