As we approach the year 2024, it’s important to be well-prepared for the changes and challenges that lie ahead in the ACA Marketplace. A recent analysis conducted by the Kaiser Family Foundation (KFF) sheds light on the evolving landscape of healthcare premiums and the factors driving their growth. In this blog post, we’ll break down the key insights from the analysis and discuss how you can guide your clients through the potential impact of these changes.

Premium Increases and Subsidies: What You Need to Know

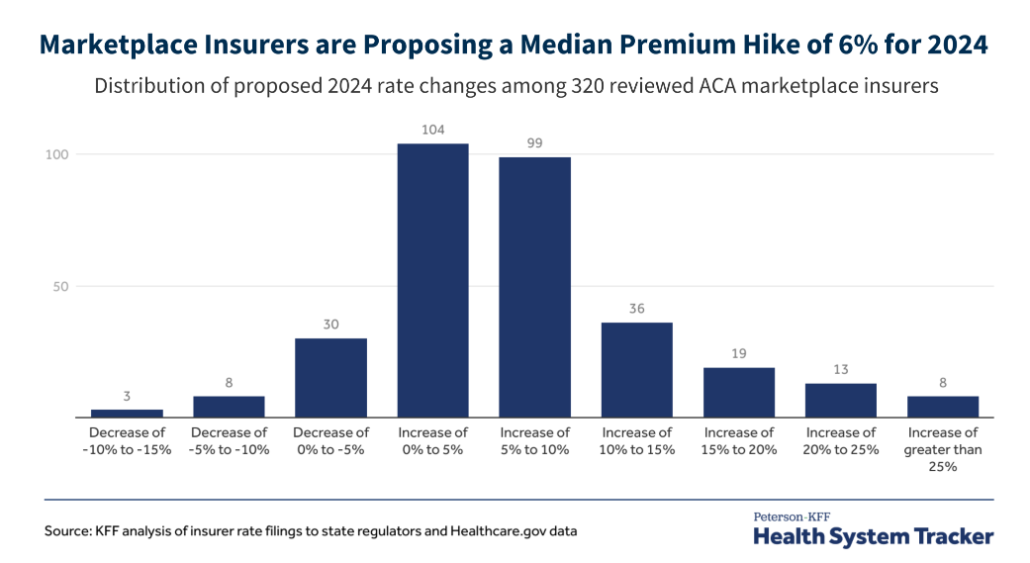

According to the KFF analysis of preliminary rate filings, ACA Marketplace insurers are requesting a median premium increase of 6% for the year 2024. While this may raise concerns among enrollees, it’s important to note that most Marketplace participants receive subsidies, which can mitigate the impact of these added costs. However, as insurance agents, it’s crucial to communicate openly with your clients about potential changes and help them understand how subsidies work.

Drivers of Premium Growth

Insurers have identified several key drivers contributing to the growth in premiums for 2024. These include price increases for medical care and prescription drugs, both of which have been consistent challenges in the healthcare industry. As an insurance agent, staying up-to-date on the pricing trends in medical care and pharmaceuticals will enable you to better explain these increases to your clients.

Utilization of Healthcare Services

The utilization of healthcare services saw a dip in 2020 due to the pandemic but has since returned to more normal levels. This uptick in healthcare utilization is contributing to the growth in premium rates. Discussing these trends with your clients can help them understand the broader context of premium increases.

The Uncertain Impact of COVID-19

The impact of COVID-19-related costs on premiums remains uncertain. While vaccine commercialization may increase costs on a per-dose basis, decreases in COVID-19 treatments and new cost-sharing arrangements for testing could potentially offset some of the premium growth. Keeping your clients informed about these nuances will demonstrate your commitment to transparency and accuracy.

Other Factors Driving Premium Hikes

Apart from the factors mentioned above, a small number of insurers have highlighted additional drivers of premium hikes. These include the unwinding of the Medicaid continuous enrollment provision, which has already led to the disenrollment of millions from Medicaid. Additionally, the introduction of new high-cost weight loss drugs has the potential to impact premiums. Discussing these lesser-known drivers with your clients can show your expertise and dedication to comprehensive guidance.

Your role in educating and guiding clients through the intricacies of healthcare insurance is paramount. The landscape of ACA Marketplace premiums is evolving, and your ability to explain the drivers behind these changes will build trust and provide a clearer picture for your clients. Remember that open communication, accurate information, and empathetic guidance are your best tools for ensuring your clients make informed decisions in 2024 and beyond.